Umbrella companies can provide numerous advantages to contractors. By working as an employed contractor under an umbrella company, contractors gain the benefit of a service that takes care of payroll and invoicing administration and helps to ensure that they are working within the guidelines set by HMRC, particularly in regards to IR35 legislation. In this article, we will discuss what an umbrella company is, as well as outlining the key advantages of using one for contractors.

What is an umbrella company?

Umbrella companies are becoming an increasingly popular option for contractors in the UK. They provide a convenient and secure solution to managing payroll, tax and other regulatory requirements. By working as an umbrella company employee, contractors can retain flexibility when it comes to the assignments they are working on, whilst enjoying some of the same benefits as regular employees, such as access to pension schemes and holiday pay. It also helps them manage their taxation obligations with HMRC by reducing the amount of paperwork that has to be completed.

What are the advantages of using an umbrella company?

Security and statutory benefits

One of the main advantages of using an umbrella company is that contractors employed by the umbrella company on a PAYE basis can access holiday pay, sick pay and other statutory employee benefits that non-employees cannot. Most umbrella companies will provide up to 28 days holiday per year including bank holidays. Additionally, if employees of an umbrella company become ill or need to take time off due to unforeseen circumstances then they may be able to access statutory sick pay, giving an added level of financial security and stability.

Benefits of working under an umbrella company can include:

- Holiday pay

- Statutory sick pay

- Statutory maternity pay

- Statutory paternity pay

- Minimum notice periods if their employment will be ending

- The right to request flexible working arrangements

Increased flexibility

Another benefit of being an employed contractor under an umbrella company is the ability to have flexibility with assignments. For instance, employed contractors are able to easily switch between clients without having to create a new business entity every time, meaning job opportunities can be taken up faster and more easily. Additionally, there are administrative advantages which come from being part of an umbrella company as you have the support of a trained payroll professional during the year-end process.

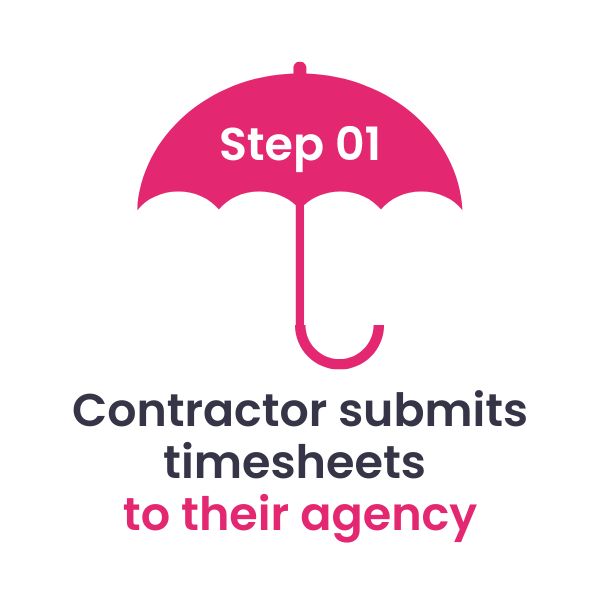

Simple payroll system

Managing your own payroll can be time consuming and complex task, therefore having an umbrella company taking care of the administration involved can be a great solution. An umbrella company is a third-party provider which takes on the responsibility of processing contractor payments.

The process with an umbrella company is relatively straightforward; contractors submit their timesheets to their agency on a weekly basis. The agency then submits a payroll spreadsheet to the umbrella company who will then invoice their clients on behalf of them. Once payment has been received by the umbrella company, they will deduct any applicable taxes and make sure that all necessary contributions are made before providing the contractor with their net salary. This makes it much easier for contractors to keep track of their income, as well as ensuring that they remain compliant with current tax regulations.

HMRC compliance

HMRC compliance is a key element for contractors and the organisations they work with. Umbrella companies can support contractors employed through them with their expert understanding of the requirements of HMRC compliance. This makes it much easier for contractors and agencies to feel confident that they are working compliantly.

The introduction of IR35 legislation has made HMRC compliance even more critical as it affects both contractors and those who employ them. It is essential to be aware of the rules around taxation and National Insurance Contributions (NICs) in order to ensure both parties remain compliant with HMRC regulations. The onus falls on the umbrella company to provide accurate reporting that clearly outlines any liabilities owed or payouts due.

Professional support and advice

Umbrella companies can also provide a valuable service for their employed contractors, offering support and advice that helps them navigate the complexities of the industry. An umbrella company is an employment intermediary that acts as an employer between contractors and their clients. It provides a range of services to contractors, including advice on tax obligations, contracts, insurance and other legal matters.

An umbrella company can help protect workers from certain liabilities that may arise due to their contractual relationship with a client or agency. This includes disputes about payment or working conditions, and any other issues related to the contract terms. Additionally, some umbrella companies may also offer additional benefits such as insurance coverage or access to financial services providers.

In summary: The benefits of using an umbrella company for employed contractors

In conclusion, being a PAYE employee through an umbrella company offers a wide range of advantages for contractors such as the ability to access employment rights and benefits, the ability to protect yourself from HMRC complications, and the peace of mind that comes with using a professional service. An umbrella company can also provide you with invaluable support and guidance throughout your contracting journey. With so many benefits on offer, it’s no wonder that more and more contractors are opting to use an umbrella company.